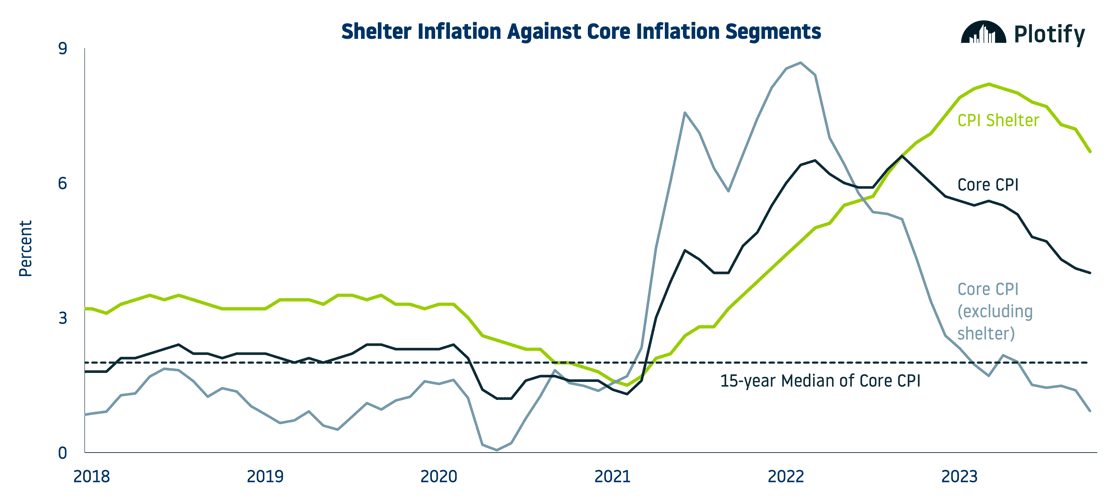

The recent release of the Bureau of Labour Statistics indicates an ongoing decline in the Consumer Price Index (CPI), a measure of the average price change over time for a basket of goods and services purchased by consumers. Core Consumer Price Index (Core CPI), which omits the prices of volatile goods and services such as food and energy, also declined to 4.0% year-over-year.

Among the underlying data from this release, shelter inflation decreased to 6.7% year-over-year. This marks the seventh consecutive month of declines since a peak in March. Given that shelter prices are a significant driver of inflation, recent declines signal easing inflationary pressures.

The index lags real-time market prices since shelter prices capture new and existing renters. Compared with private indexes tracking asking rent, such as Zillow or Apartment List, the BLS shelter prices lag. More recent declines observed in private rent indexes suggest that CPI shelter prices will continue to decline, placing downward pressure on CPI.

Similarly, the San Francisco Federal Bank anticipates shelter inflation to continue cooling into 2024. These downward trends are a promising sign for the Fed's inflation target of 2.0%.

Since yesterday's drop in inflation, mortgage demand has already increased to 5-week highs. Increases in homebuyer demand due to lowering rates could place additional upward pressure on home prices within markets with an already tightly constrained supply of homes for sale.

Plotify's Takeaway:

- October's Core CPI rose 4.0% year-over-year, signaling a downward trend in underlying inflation.

- Shelter inflation dropped to 6.7% year-over-year, continuing a seven-month decline, indicating a potential easing of overall inflation.

- The San Francisco Federal Bank predicts shelter inflation will continue to decrease into 2024.

.jpg)

.jpg)

.jpg)

.jpg)