As we enter 2024, this Plotify Insight explores ongoing post-pandemic housing market shifts, household formation trends, and how rising rental and homeownership costs continue to shape the single-family housing market.

A Stabilizing Rental Market

The rental market broadly stabilized in 2023 after experiencing record demand in 2022, which is attributed to years of under-building and a surge in household formation post COVID-19. Rent growth moderated and aligned closer to long-term trends.

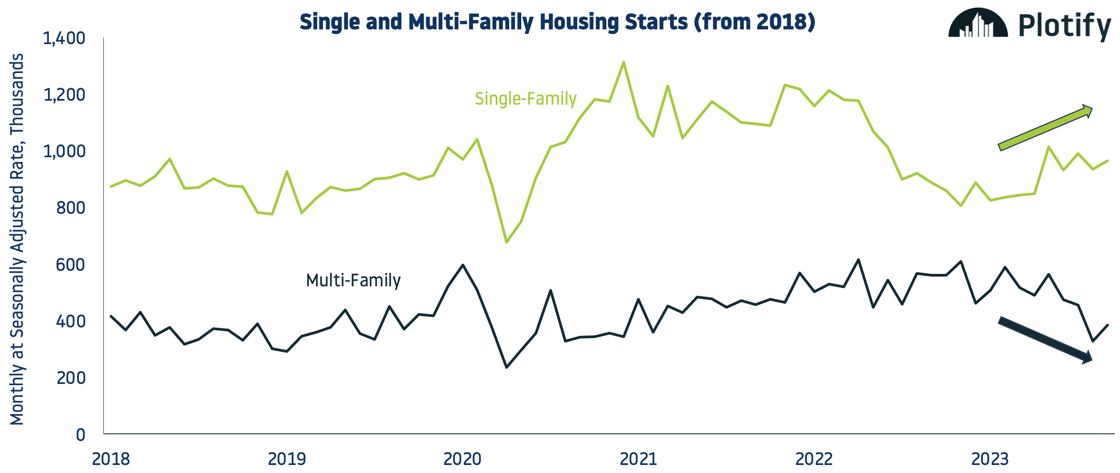

As part of this stabilization, a significant pipeline of new units is under construction across the country. This expansion encompasses a pivot to single-family housing construction: recent statistics show a 13.1% annual increase and the highest single-family permit levels since May 2022, signaling a sustained focus on expanding the single-family market amidst high costs and interest rates.

As we approach 2024, the increase in housing starts will help normalize vacancy rates back toward long-term averages, fostering a healthier supply and demand balance and preserving the affordability of renting. Regardless, we can still expect that the annual pace of rent growth will remain strong for single-family homes.

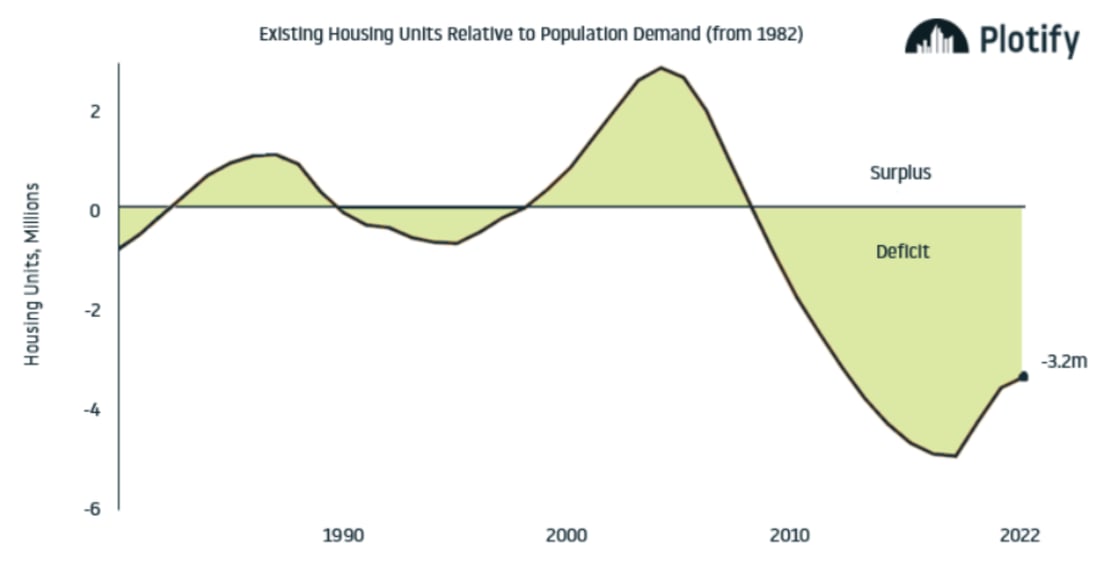

Household Formation Outpacing Supply

While the market has experienced recent increases in single-family housing starts, the current rental housing shortage is the result of decades of under-building – even a few years of increased production will not suffice to resolve the undersupply crisis. In an analysis by Realtor.com, household formation is outpacing construction with a gap of 2.3 million homes, whereas an analysis by Hines places this figure higher at a deficit of 3.2 million for 2022.

Nonetheless, housing supply in 2024 will remain an area of focus as forecasts predict a 0.4% increase in single-family starts in a modest but continuous response to demand.

Additionally, while new construction tends to be more expensive than existing home inventory, the trend among builders to create smaller, more affordable properties is expected to persist and gain momentum in 2024. Yet, affordability remains at a record low, forcing many potential home buyers to stay in the rental market.

Dealing With the Rising Cost of Home Ownership

Limited housing supply and skyrocketing home prices and mortgage rates have significantly increased the cost of purchasing a home, effectively barring many first-time buyers from entering the market.

On average, monthly mortgage payments for new homes now exceed half the cost of renting an apartment. This dynamic is expected to sustain strong demand for rentals in 2024 as it is cheaper to rent than to buy, with the Economist estimating that average mortgage rates would have to fall to 3.2% or rental costs would have to rise by at least 50% for a reversal of trends.

The industry saw monumental impacts in 2023 from rising insurance premiums and interest rates. Insurance costs per unit have surged by 33% year-over-year, with the increasing rates adding to the overall cost of living for individual homeowners. Though these challenges are expected to persist, as covered in a previous Plotify Insight, Fed projections for interest rates and inflation are set to fall 4.6% and 2.6%, respectively, in 2024, which could provide some relief and necessary cooling.

While rent prices differ from market to market, renting remains the more affordable option in most markets. While there is no doubt that new challenges will emerge in 2024, rental housing will continue to be a cornerstone of a well-balanced asset portfolio in light of constrained housing supply, continued demographic growth, and lowering interest rates.

Plotify’s Takeaways:

- 2024 could see heightened single-family home prices and rental growth, outperforming multi-family as the rental market stabilizes.

- With housing demand outpacing supply, single-family starts are forecasted to increase slightly but remain low compared to strong household formation.

- Amidst the Fed's efforts to lower rates and inflation in 2024, the affordability of renting over buying could intensify competition in the rental market.

.jpg)

.jpg)

.jpg)

.jpg)